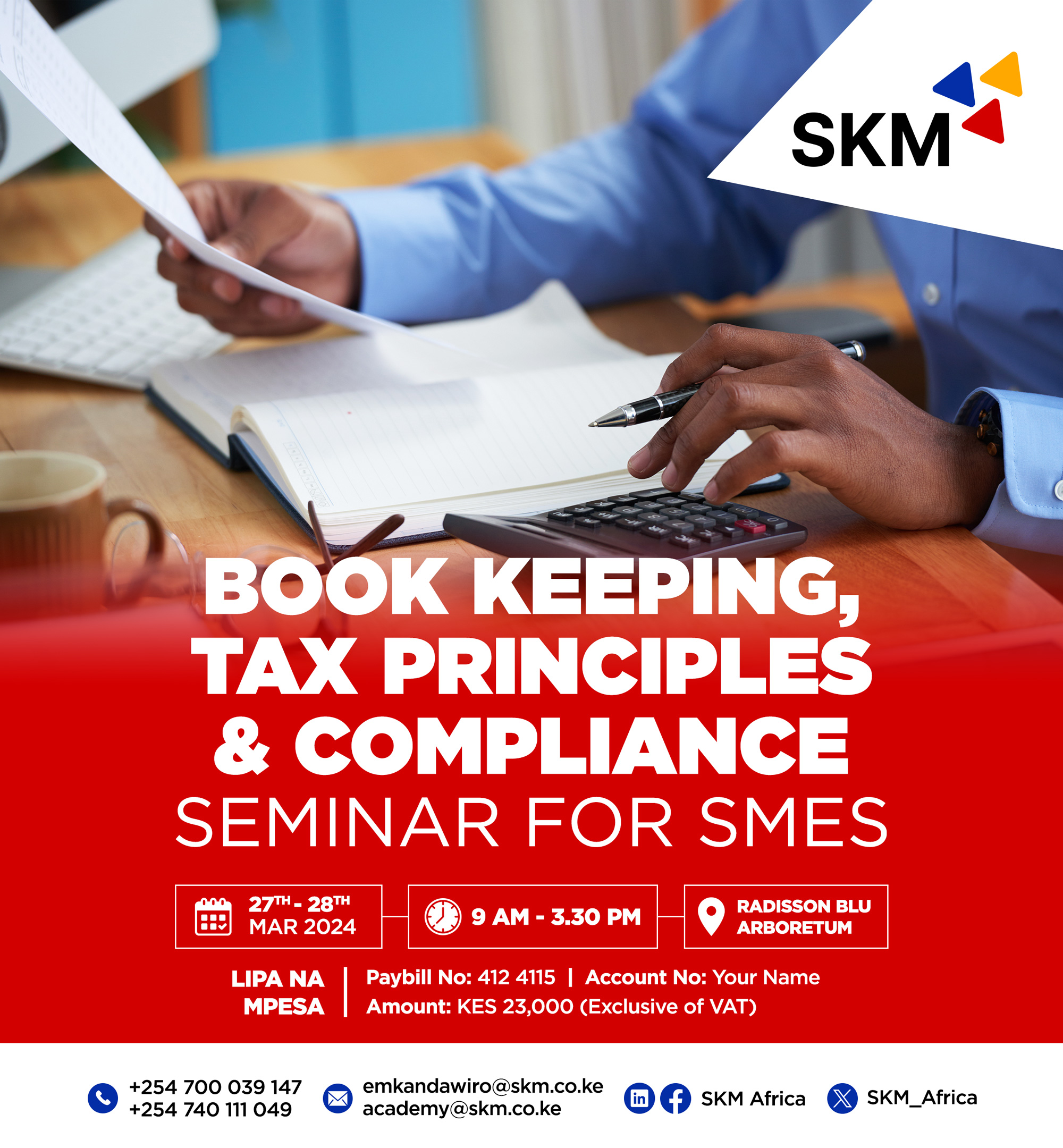

Book Keeping, Tax Principles and Compliance Seminar for SMEs Physical Event

Training Registration

Training Date(s)

28 Mar - 29 Mar 2024

Training Charge

KES 23,000.00

Training Time

9:00 PM - 4:00 PM

Training Venue

Radison Blue, Arboretum

About the training

With increased compliance requirements especially from a tax perspective, proper bookkeeping and awareness of tax compliance intricacies has become extremely vital for all businesses and business owners. The introduction of eTIMS invoicing has also now made the above more critical as most corporate customers will now require eTIMS invoices to be able to claim any expenses.

Book keeping forms a source of essential financial information necessary for ensuring compliance as well as exercising financial control over the business. Knowledge and skills in bookkeeping are major factors that impact positively on sustainability and growth of SMEs. Failure to record financial transactions leads to collapsing of the business within a few months/years of its establishment.

|

Area |

Speaker |

|

Accounting Principles applicable to SMEs |

SKM Finance & Tax Experts |

|

Challenges facing SMEs in bookkeeping and tax compliance |

SKM Finance & Tax Experts |

|

Key tax considerations relating to the operation of SMEs |

KRA SME sector lead |

|

SME relevant tools that can aid in bookkeeping and tax compliance |

SKM Finance & Tax Experts |

The application of accounting records seriously influences the achievement of a company’s objectives.

The aim of the training is to enhance understanding of the best practices relating to bookkeeping as well as tax compliance for SMEs to ensure that SME owners and staff are able to efficiently carry out their business operations while remaining tax compliant.