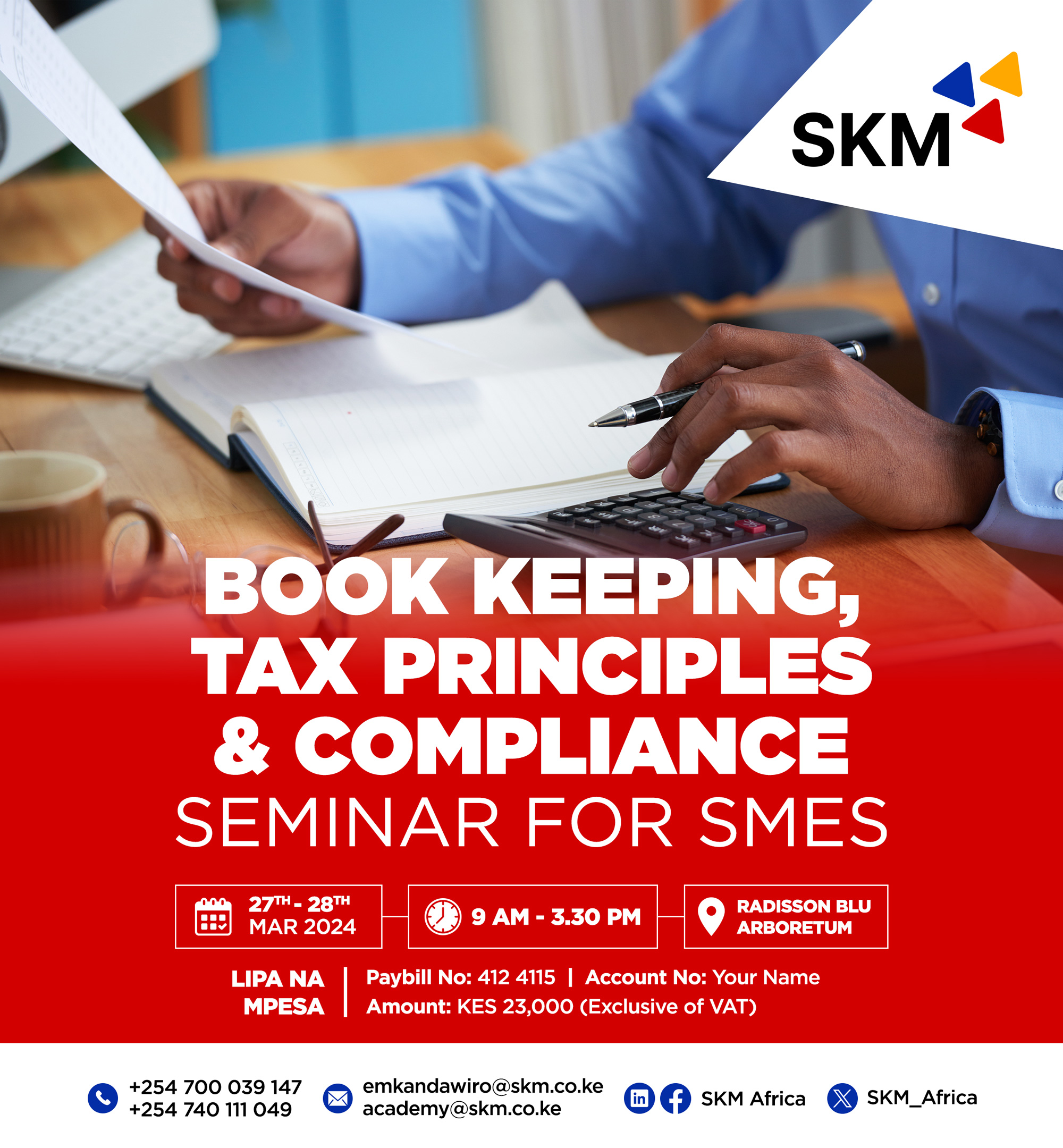

With increased compliance requirements especially from a tax perspective, proper bookkeeping and awareness of tax compliance intricacies has become extremely vital for all businesses and business o...

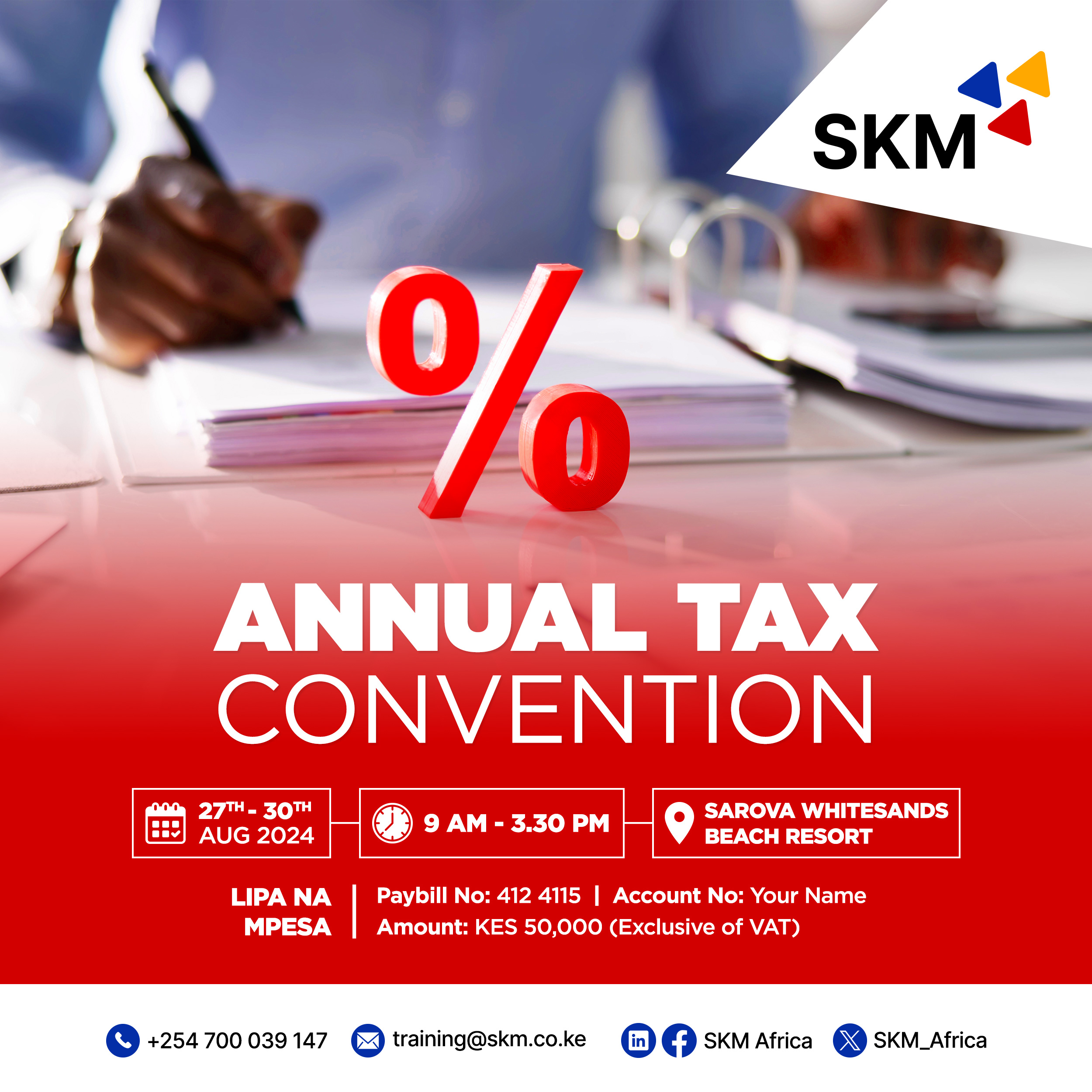

Annual Tax Convention Physical Event

Training Registration dfsd

Training Date(s)

27 Aug - 30 Aug 2024

Training Charge

KES 50,000.00

Training Time

9:00 AM - 4:00 PM

Training Venue

Mombasa

About the training

Worldwide, governments are actively seeking innovative taxation strategies to mitigate negative externalities and fund the provision of public goods and services in an evolving global landscape. Taxation plays a crucial role in fostering economic growth and development. It serves as a means for governments to generate revenue to fund programs and meet fiscal requirements. While the primary objective of taxation is revenue generation to support government functions, it is also frequently used as a regulatory tool to achieve specific effects or conditions envisioned by the government.

The global social and economic landscape is undergoing significant transformation due to rising innovation across all sectors of the economy. Crucial factors driving this change include the free movement of capital and labor, the relocation of manufacturing from high-cost to low-cost regions, the gradual dismantling of trade barriers, advancements in technology and telecommunications, and the growing emphasis on risk management, intellectual property development, protection, and exploitation. These influential trends have profoundly affected business practices, leading to dynamic shifts in traditional business models and the management of fiscal and monetary policies, as well as shaping the development agendas of countries concerning public finances, taxation, and growth trajectories.

It is the responsibility of the government to establish a just tax system that promotes fair distribution of income and enhances the welfare of citizens. Similarly, all other stakeholders involved in tax collection and management should strive within legal boundaries to minimize the burden of tax compliance for individuals and businesses. Given its significance, discussions and decisions regarding tax policy become a vital concern for the public, businesses, and the overall economy due to the diverse impact it will have on each of these stakeholders. In light of this observation, this conference will offer a platform for key tax stakeholders to address important issues related to tax compliance in national tax administration.

Some of the aspects regarding taxation that will be discussed include:

- Recent changes in the Kenyan taxation landscape..

- Impact of tax on cross-border transactions (Transfer pricing).

- Implementation and Implications of the Finance Act 2024 provisions.

- Tax technology and modernization; e-Tims, digital services and returns.

- The influence of taxation on sustainability efforts and reporting

Additional Details

Continuous professional development

Upon completion of the course, CPD points will also be awarded to all trainees, which can then be redeemed from the Institute of Certified Public Accountants of Kenya (ICPAK).

National Industrial Training Authority (NITA) Reimbursement

Please note that we are also registered with the National Industrial Training Authority (NITA). Our registration number is NITA/IT/IBTA/F/11.

Participants who are registered levy contributors can apply to NITA for reimbursement of the fees. To qualify you should apply to NITA for approval prior to the date of the conference.